I Used to Be Cool

- Eric Cinnamond

- Aug 11, 2025

- 5 min read

<August 11, 2025>

One of the top bumper stickers of all time—I Used to Be Cool—is often spotted on minivans. I can relate. After our first child was born, we purchased a minivan. Initially, I dreaded driving the giant shoebox on wheels. But over time, it grew on me. It had captain’s chairs, sliding passenger doors, and surprisingly good acceleration. Most of all, it was practical—ideal for road trips, errands, and hauling almost anything. Minivans may not be cool, but if you own one, you know exactly what I’m talking about—they’re underrated and incredibly useful.

We view dividends as the minivans of investing: not overly exciting, but practical and reliable in helping us reach our destination.

I was first introduced to dividend investing in 1996, when I was hired as an analyst for a small cap equity income fund. It was a unique strategy that continues to influence how we invest today. Companies that pay dividends tend to be established, generate free cash flow, and typically have more predictable operating results. In effect, they’re often more consistent businesses that can be valued with a higher degree of confidence. In other words, the type of companies we like to own at Palm Valley.

Since my early days as an analyst, companies have increasingly shifted their capital allocation away from dividends and toward stock buybacks. Buybacks offer tax advantages, are viewed as more flexible, and can boost earnings per share. They also create an additional source of demand for a company’s stock, benefiting the share price. Unsurprisingly, the rise in buybacks has coincided with the growth of equity-based compensation. The road to executive riches is rarely paved with dividends!

The market’s dividend yield was once a widely used valuation tool. If applied today, the market’s minuscule yield would confirm what we already know—stocks are extremely expensive. But like other valuation metrics, the overall yield is being skewed by large-cap stocks. Beneath the surface, we’re finding a number of small-cap companies that still offer attractive dividends.

Small-cap dividend stocks have significantly underperformed large-caps, especially high-momentum names like the Mag7. Why bother with a 3%-5% dividend when you can invest in a momentum favorite and make a year’s worth of dividends in one day! While dividend payers may offer steady income, they lack the sizzle and get-rich-quick upside of today’s top performing equities.

The sharp rise in longer-term U.S. Treasury yields—along with competitive money market rates—has also contributed to the waning interest in dividend-paying stocks. By contrast, during the era of ZIRP and negative real rates, dividends were seen as one of the few reliable sources of income and were viewed much more favorably by investors.

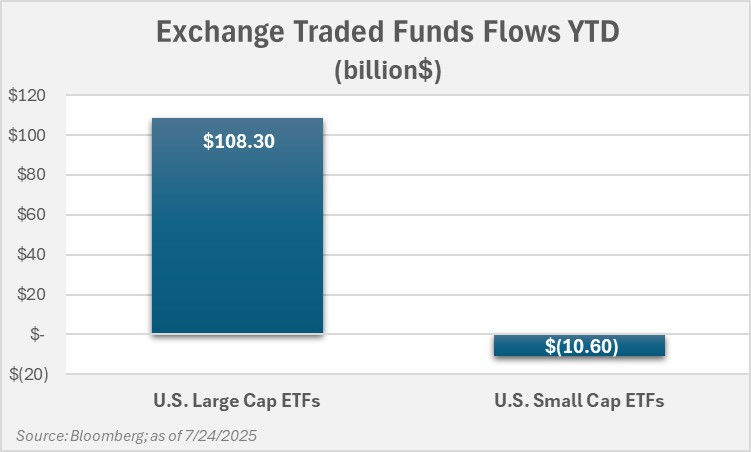

Finally, we believe investment flows are contributing to the underperformance of small-cap dividend payers. Passive strategies continue to channel capital into large-cap benchmarks and top-performing stocks. At the same time, dividend-paying companies often retain less cash for buybacks, reducing another source of demand for their shares. As a result, stocks benefiting from the two largest price-insensitive buyers—passive flows and buybacks—have generally outperformed small-cap dividend payers.

As investors chase the high-flying mega caps, we’re finding value in small-cap dividend stocks. In fact, most of the equities we owned as of June 30, 2025, pay dividends.

While we recognize the risk of potential dividend cuts, we believe the majority of dividends from the companies we own will be maintained. We’re focusing on businesses that we expect to generate sufficient free cash flow to fund dividends—even in the challenging conditions that several are currently experiencing.

With stock buybacks and mega-cap investing soaring in popularity, we believe certain small-cap dividend stocks are being overlooked. We are grateful. While we don’t know when they’ll come back into favor, we’re happy to collect their dividends while we wait. And who knows, if the Fed chickens out (F.A.C.O.) and cuts rates, investors may return to dividend-paying stocks sooner than expected. Regardless, we’re not waiting for investor perceptions and allocations to change. We still think dividends are cool.

Eric Cinnamond

The Palm Valley Capital Fund can be purchased directly from U.S. Bank or through these fund platforms.

There is no guarantee that a particular investment strategy will be successful. Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Past performance does not guarantee future results. It is not possible to invest directly in an index.

Fund holdings and allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk. Click here for the fund’s Top 10 holdings.

Mutual fund investing involves risk. Principal loss is possible. The Palm Valley Capital Fund invests in smaller sized companies, which involve additional risks such as limited liquidity and greater volatility than large capitalization companies. The ability of the Fund to meet its investment objective may be limited to the extent it holds assets in cash (or cash equivalents) or is otherwise uninvested.

Before investing in the Palm Valley Capital Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. The Prospectus contains this and other important information and it may be obtained by calling 904 -747-2345. Please read the Prospectus carefully before investing.

Nothing contained in this communication constitutes tax or investment advice. Investors must consult their tax advisor for advice and information concerning their particular situation.

There is no guarantee that a company will pay or continue to pay or increase its dividend.

The Palm Valley Capital Fund is distributed by Quasar Distributors, LLC.

Definitions:

Mag7: The Magnificent Seven (Mag7) stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Broadcom, Meta Platforms, Microsoft, and NVIDIA.

Wisdom Tree Small Cap Dividend Index: A stock market index designed to measure the performance of small-capitalization companies in the United States that pay regular cash dividends.

Exchange Traded Fund (ETF): An investment fund that holds multiple underlying assets and can be bought and sold on an exchange, much like an individual stock.

S&P 500: The S&P 500 Index is a list of 500 of the largest public companies in the U.S. These companies are the biggest and most important companies in the country, and represent a broad cross-section of the economy.

Real Rates: A real interest rate is an interest rate that has been adjusted to remove the effects of inflation. Once adjusted, it reflects the real cost of funds to a borrower and the real yield to a lender or to an investor.

ZIRP (zero interest rate policy): A method of stimulating growth while keeping interest rates close to zero.

Free Cash Flow: The cash a company has left after spending money to support and maintain its operations and capital assets.

Dividend Yield: A ratio that demonstrates a company's annual dividends relative to its shares' market price.

The Bloomberg Magnificent 7 Index: a stock market index that tracks the performance of seven of the largest and most influential U.S. technology and tech-adjacent companies.

Comments