The Fed's Labor Trap

- Eric Cinnamond

- Nov 30, 2021

- 7 min read

<November 30, 2021>

Whether bullish or bearish, few can argue this is not one of the most fascinating times in the history of financial markets. Last week equities reached another record high, bolstered by strong earnings and the Federal Reserve, which remains committed to its 0% fed funds rate and a dovish taper. It appears investors continue to assume business as usual, with ultra-easy monetary policy always being there to save the day.

As the Fed maintains its policy of negative real interest rates and debt monetization, signs of real-world inflation are accelerating as numerous companies disclosed during the latest round of quarterly conference calls. Management descriptions of the current inflationary environment ranged from extreme to unprecedented.

To date, inflation has been a gift for most equity investors and corporations. While some companies have seen their profit margins squeezed, most have been able to grow revenues and earnings through frequent and aggressive price increases. According to The Wall Street Journal, “Nearly two out of three of the biggest U.S. publicly traded companies have reported fatter profit margins so far this year than they did over the same stretch of 2019.” As inflation boosts margins and profits in the near-term, equity investors have benefited.

Providing further support to equity prices is the bond market, which, given the current inflationary environment, has remained surprisingly well behaved. With the Federal Reserve’s foot on the neck of any remaining bond vigilantes (free markets), the bond market is struggling to properly respond to rising inflation. In effect, equity investors are being rewarded for the ability of corporations to raise prices but are not being penalized by the higher interest rates normally associated with rising inflation.

During its recent earnings call, Packaging Corp of America (manufacturer of containerboard and corrugated packaging) illustrated what many of the businesses we follow are experiencing. Packaging Corp had a very strong quarter with sales and earnings increasing 18% and 71%, respectively. Although strong demand and volume contributed, most of the improvement was driven by price increases. In other words, Packaging Corp was successful in passing on a variety of rising costs. No surprises there as it’s what we’ve been noticing with many of the companies we follow. What was surprising is after management commented on “unprecedented inflation-related challenges,” they disclosed that the company was able to issue $700 million of 30-year notes with a 3.05% coupon.

While we have a high opinion of Packaging Corp, we have to ask, “How in the world does a cyclical business borrow $700 million for 30 years at 3.05%?” And to top it off, they’ll enjoy these terms in what the company describes as an unprecedented inflationary environment! We believe this is another example of how businesses and investors are being rewarded for inflation, while they are not being penalized by higher interest rates that, excluding Fed intervention, would be free to respond to rising inflation.

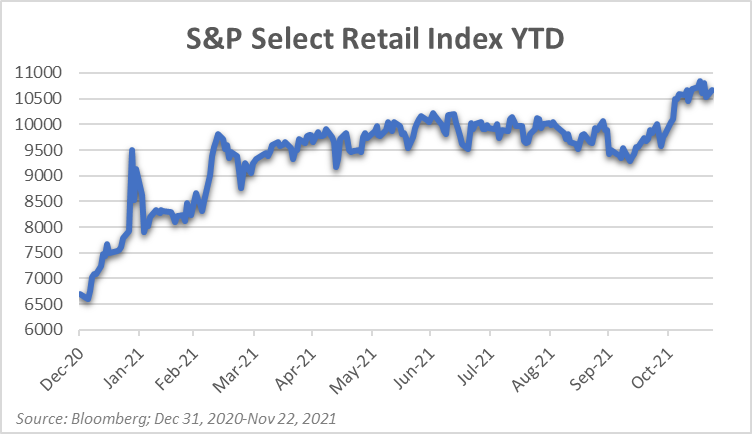

Retailers have been doing particularly well in the current inflationary environment as rising prices have aided same-store sales and earnings growth. Strong results have vaulted the S&P Select Retail Index up 60% YTD! Last week, Home Depot reported sales and earnings grew 10% and 23%, respectively. Their impressive results benefited from inflation, not necessarily demand (transactions), with management noting, “Our comp average ticket increased 12.7% and comp transactions decreased 5.8%. Growth in our comp average ticket was driven in part by inflation across several product categories.”

While most of the businesses we follow have been successful at passing on rising costs, some businesses remain behind the curve. TreeHouse Foods recently forecasted a very disappointing outlook, citing continued cost increases in commodities, packaging, freight, and labor. Similar to Packaging Corp, management characterized the escalation and duration of inflation as “unprecedented.” And while TreeHouse has been able to pass on price increases, they have much more work to do. During the third quarter, the company raised prices 3% (not enough) and in the current quarter raised prices 4% to 5% (not enough). In 2022, management expects pricing to increase in the “low double-digits” (will it be enough?).

Rising labor costs were particularly noticeable in recent earnings results and conference calls. This should be concerning for Fed members hoping inflation will subside, as labor inflation is typically stickier than inflation associated with volatile commodity prices. TreeHouse Foods discussed labor in detail during its conference call, calling rising labor costs structural. Management explained, “We typically don't price for labor. We typically price for commodities and for freight. And what we've done in this case is we've priced for the structural change, what we view as a structural change in labor.”

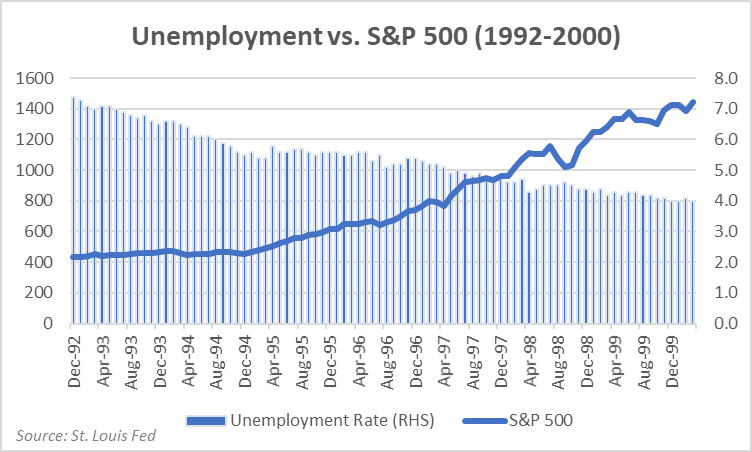

What has caused the structural shift in labor? While COVID-related issues are likely contributing, we believe the tight labor market is also a result of a prolonged economic cycle built on easy money and inflated asset prices. Put simply, as the market and economic cycles have matured, labor has gotten consistently tighter. We’re reminded of 1999 when the labor market was also tight and asset prices were booming. Similar to today, for those fortunate enough to ride the wave of asset inflation, the need to work diminished as asset prices rose.

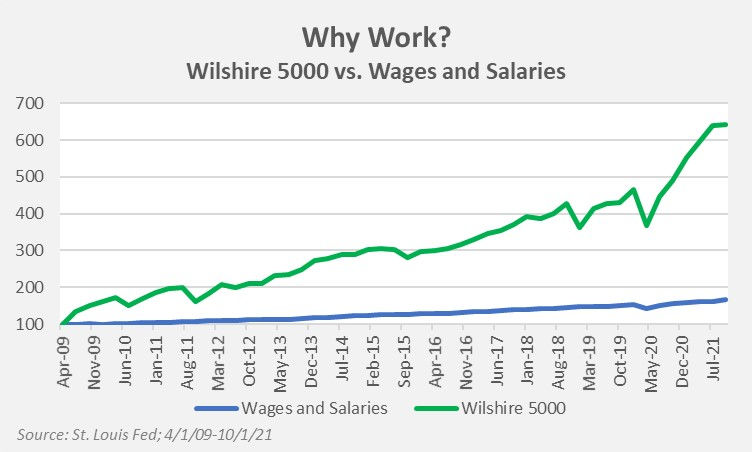

Like 1999, we believe rising asset prices are currently contributing to a growing number of workers choosing to live off asset inflation instead of traditional employment. According to The Wall Street Journal, “Individual investors opened more than 10 million new brokerage accounts in 2020.” Guess how many job openings businesses are currently attempting to fill? You guessed it—10 million! Specifically, according to the latest Jobs Openings and Labor Turnover Survey (JOLTS), the number of job openings was 10.4 million at the end of September. Now add an estimated 100 million cryptocurrency accounts to the mix, and it shouldn’t be surprising employers are having difficulty finding sufficient labor. If you’re still confused about the relationship between asset inflation and labor shortages, just ask any truck driver, “Would you rather sit at home watching asset prices rise without effort or haul a full truckload of merchandise across the country on congested highways?”

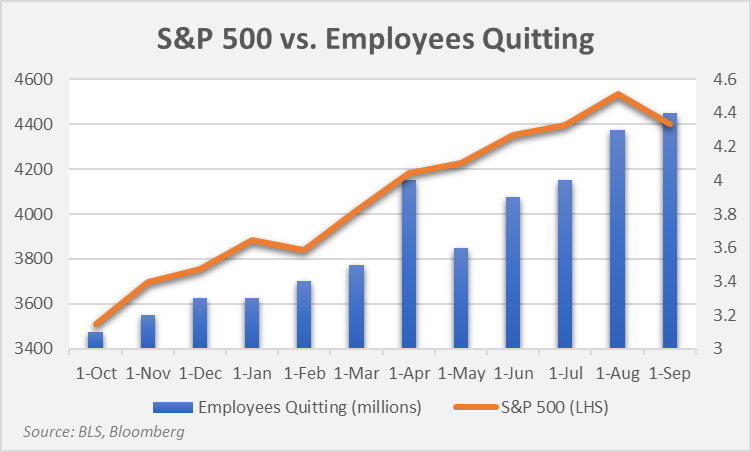

As asset inflation and brokerage account balances soar, working for a living is becoming less appealing, and in some cases, unnecessary. Quit rates among employees have also become highly correlated with asset prices. Employees must be asking themselves, “Why work when I can comfortably ride the wave of asset inflation?” We’re left wondering if the challenge of finding sufficient labor can be resolved without a bear market in risk assets.

The Federal Reserve doesn’t seem overly concerned. In fact, the Fed continues to believe the labor market hasn’t reached full employment, using the supposed slack in the labor market to justify 0% rates while inflation is running at a 30-year high. Meanwhile, corporations are unable to meet demand, with many businesses running understaffed and below full capacity.

Instead of proactively addressing the extremely tight labor market, we believe the Federal Reserve is simply hoping labor pressures and the resulting inflation subside on their own. Instead of going away, we’ve been documenting accelerating labor pressures and wages within our small cap opportunity set. In our opinion, the Fed’s asset bubbles are making matters worse by simultaneously inflating the demand for labor while reducing its supply (the need to work). In effect, as long the Fed allows its asset bubbles to inflate, we believe labor shortages and wage increases will not only persist, but will likely accelerate.

While we are fascinated by the Federal Reserve’s predicament, we have zero interest in allocating capital based on the belief that they’ll succeed in getting out of their inflationary labor trap. Instead of force investing in what we believe is the most expensive small cap market in our careers, we are patiently waiting for volatility and opportunities to reappear. Although it’s difficult to predict when volatility returns and the current market cycle ends, we believe the synchronized rise in labor demand and fall in labor supply should be added to the growing list of potential catalysts.

Eric Cinnamond

The Palm Valley Capital Fund can be purchased directly from U.S. Bank or through these fund platforms.

The information on earnings growth is based on certain assumptions and historical data and is not a prediction of future results.

Index performance is not indicative of a fund’s performance. It is not possible to invest directly in an index. Past performance does not guarantee future results. Current performance of the Fund can be obtained by calling 904-747-2345.

There is no guarantee that a particular investment strategy will be successful. Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Fund holdings and allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk. Click here for the fund’s Top 10 holdings.

Mutual fund investing involves risk. Principal loss is possible. The Palm Valley Capital Fund invests in smaller sized companies, which involve additional risks such as limited liquidity and greater volatility than large capitalization companies. The ability of the Fund to meet its investment objective may be limited to the extent it holds assets in cash (or cash equivalents) or is otherwise uninvested.

Before investing in the Palm Valley Capital Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. The Prospectus contains this and other important information and it may be obtained by calling 904 -747-2345. Please read the Prospectus carefully before investing.

The Palm Valley Capital Fund is distributed by Quasar Distributors, LLC.

Definitions:

Real interest rate: an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost to the borrower and the real yield to an investor.

Coupon: the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

S&P Select Retail Index: an index that comprises of 107 stocks that are classified in the retail sub-industry.

Comp average ticket: The comparison of the average ticket or receipt from a retailer versus a year ago.

Comp transaction: The comparison of the number of transactions of a retailer versus a year ago.

S&P: Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices and an issuer of credit ratings for companies and debt obligations.

Cryptocurrency: A digital currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

Wilshire 5000: The broadest stock market index of publicly traded American corporations that is often used as a benchmark for the entirety of the U.S. stock market.

Comments